Disputes are an unfortunate aspect of accepting payments online and the best way to manage them is to prevent them from happening at all. An effective dispute and fraud prevention strategy uses a number of methods that are best suited for your business while keeping any customer burden—and losses—to a minimum.

A dispute (also known as a chargeback) occurs when a cardholder questions your payment with their card issuer. This can be an honest mistake as some people share credit cards with family members or significant others, and may not be familiar with a specific charge if not made by them. It may also be something as easy as the cardholder not remembering or recognizing the charge on their statement (which is why you should make sure your business name is clear and concise in your Stripe account). Once a dispute is reported, the issuer creates a formal dispute which immediately reverses the payment. The payment amount, along with a separate $15.00 dispute fee (for users in the United States) levied by the card network, is then deducted from your account balance.

As already mentioned, the best offense is a good defense. If you are concerned about disputes or fraudulent charges, there are two areas to review that impact the credit card transaction – FetchRev & Stripe.

FetchRev

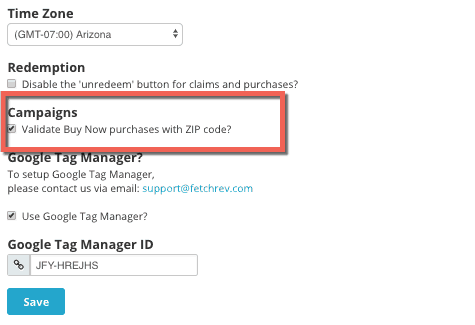

In your FetchRev account settings, you can adjust what information is collected at the time of purchase. The more information that is collected, the better chance you have of winning the dispute. By default, FetchRev requires the customer to enter the CCV# of the credit card. However, you can also require the purchaser enter their ZIP code as well.

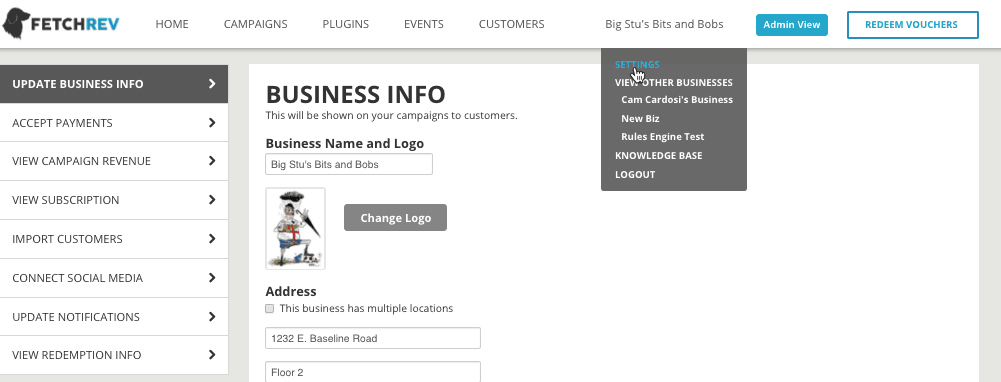

- Select Settings under your business name.

- Click Update Business Info from the left-hand navigation.

- Scroll to the bottom of the page and select Validate Buy Now purchases with ZIP code?

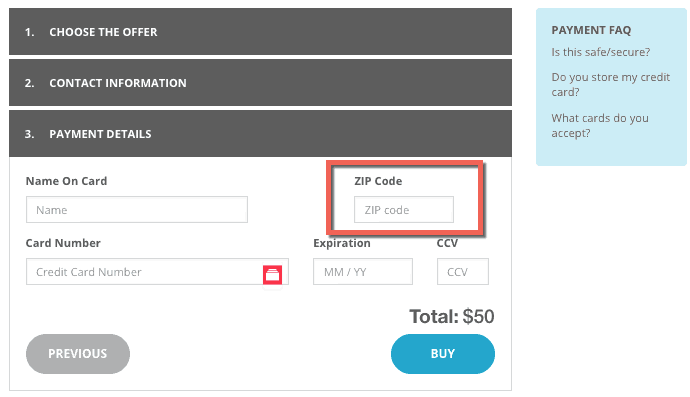

Once you have selected this option, all Buy Now purchases will require the user to enter their ZIP code as part of the purchase process.

Stripe

The second area to review is Radar, Stripe’s fraud prevention toolset. Radar is built directly into the payment flow and combines a customizable rules engine with powerful machine learning algorithms. This process detects patterns across payments processed with Stripe, assessing the risk level of each. You can also adjust these settings.

It’s important to keep in mind that every additional piece of information/step you require a customer to take can impact your conversion rate on your offer. For example, your business makes 300 transactions in a month from a Buy Now campaign at $50 per transaction but receives 2 chargebacks totaling $100. That means your business still took in $14,900 in revenue. If you tighten your security and your conversion rate goes down by 5%, that means you only have 285 transactions and a resulting revenue of $14,250 – A LOSS OF $750. Was the additional security worth it? Perhaps, but that’s a decision that you need to carefully weigh as a business owner.

Next Steps Should You Recieve A Dispute

The first step you should take with any dispute is to contact the customer to inquire about why the charge was disputed. This will often resolve the issue, and they will remove the dispute. If a customer is unwilling to remove the dispute from the charge, we suggest that you submit evidence to Stripe in order to demonstrate the validity of the purchase. If the dispute is found in your favor, the disputed amount and fee is returned back to you. If a dispute is upheld, the card issuer’s decision is final and the cardholder’s payment remains refunded.

If you need a Confirmation Message/Receipt for a specific purchase due to a dispute, please contact us at support@hownd.com and our team will be able to assist you.

Click here for additional information on disputes from the Stripe FAQ.